Jet.com launched one year ago and raised more than $500 million

By GREG BENSINGER and SARAH NASSAUER

Wal-Mart Stores Inc. is in talks to buy online discount retailer Jet.com Inc., according to people familiar with the matter, escalating its costly quest to compete head-on withAmazon.com Inc.

A deal could give Wal-Mart’s e-commerce efforts a much-needed jolt as the world’s largest retailer seeks to grow beyond its brick-and-mortar storefronts with speedy home delivery from a network of massive suburban warehouses.

It isn’t clear how much Wal-Mart would pay for the unprofitable startup, but a person familiar with the matter said Jet could be valued at up to $3 billion. That would be Wal-Mart’s biggest acquisition since buying South African retailer Massmart Holdings Ltd. for $2.3 billion in 2010, a sign that executives at the retail behemoth are willing to spend big to catch up with Amazon.

“Wal-Mart could certainly use some energy” around its online efforts, said Bryan Gildenberg, an analyst at Kantar Retail. “I’m struggling with the math of why you would pay this much money for this [business] model at this particular time.”

Jet, barely a year old, has sought to underprice Amazon with a vast marketplace that would require billions of dollars in funding and a plan to rely more on suppliers than warehouse inventory. A part of its growth strategy early on relied on taking orders for products it didn’t sell and placing orders on behalf of its customers on other sites, often selling the items below what it paid while absorbing steep shipping costs. Jet has curtailed the practice.

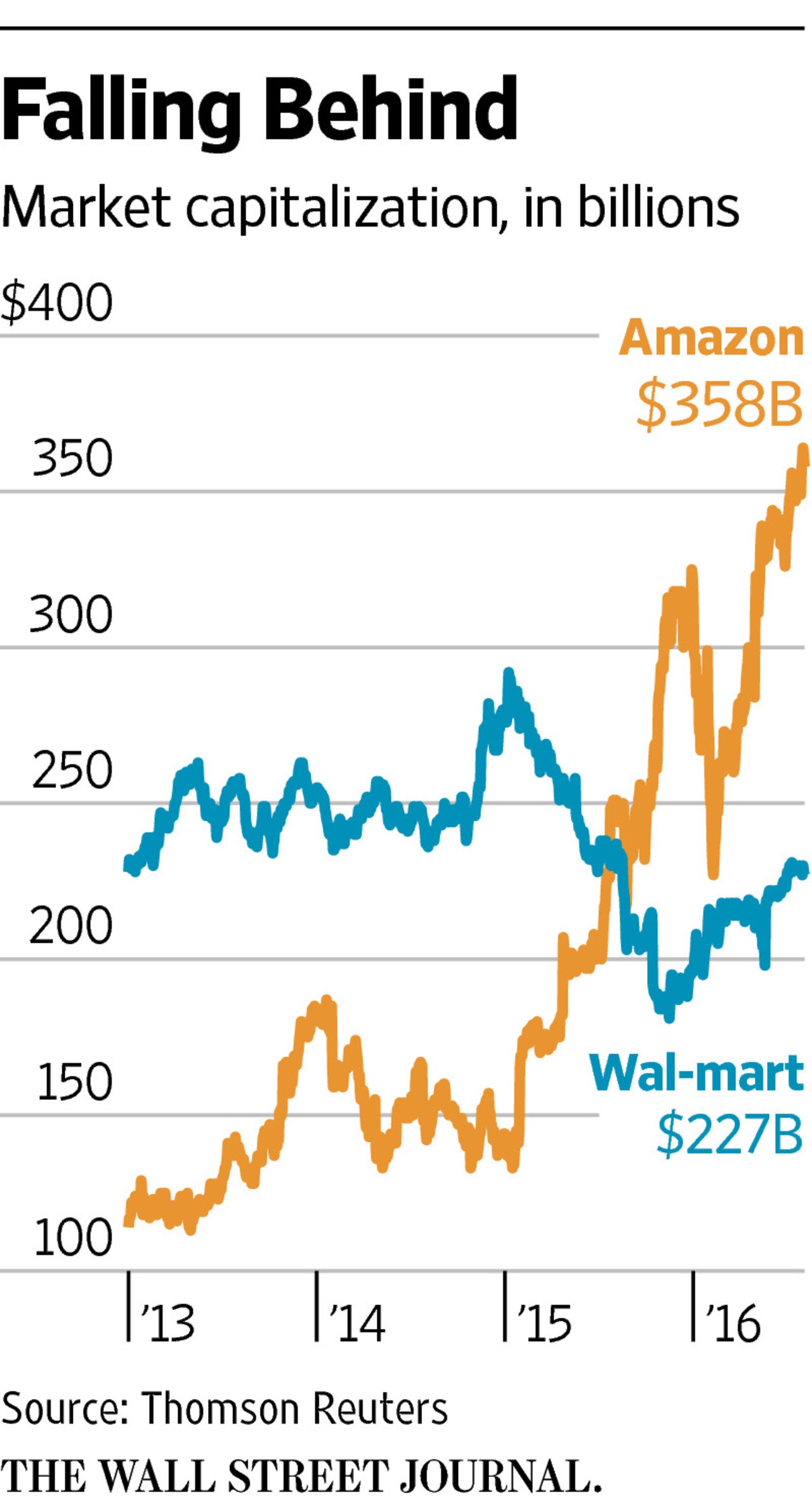

Wal-Mart has scrambled to keep pace with Amazon, which overtook Wal-Mart by market capitalization a year ago and now sports a market value that is 50% larger. Wal-Mart’s e-commerce sales reached nearly $14 billion, or 3% of its $482 billion in annual revenue last year. Amazon’s revenue was $107 billion last year, including its Web-services business.

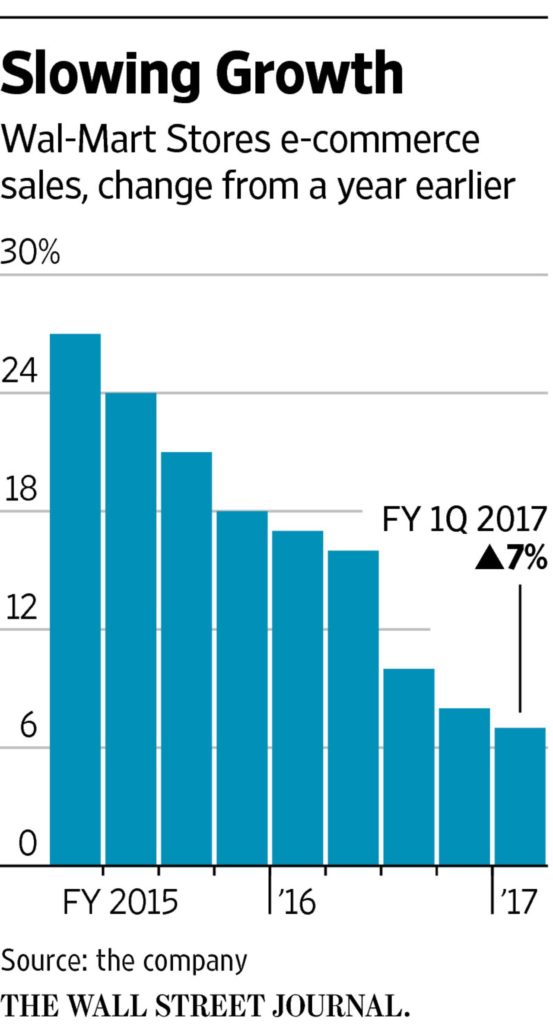

The Bentonville, Ark.-based retailer has pledged $2 billion to boost e-commerce sales, building new fulfillment centers and supporting a two-day free shipping service that targets Amazon’s popular Prime service. It has also tried to goose sales with local grocery delivery and curbside pickup services. But online growth has slowed for nine straight quarters.

In an earnings conference call in May, Wal-Mart Chief Executive Doug McMillonacknowledged his company’s e-commerce growth “is too slow” and that the company needed to expand the number of products sold on its site and give third parties more access to its website.

For Jet, a takeover by an old-line retailer would demonstrate the challenges of attempting to go it alone in the hypercompetitive e-commerce market. Started and led by Diapers.com founder Marc Lore, Jet is challenging Amazon and Wal-Mart by offering lower prices based on a formula that takes into account basket size and the proximity of the merchandise to buyers, as well as other factors.

Jet has drawn more than $500 million in capital from the likes of venture firms New Enterprise Associates and Accel Partners, mutual-fund company Fidelity Investments and bank Goldman Sachs Group Inc. The funding, and a valuation over $1 billion, are massive sums for a company facing the prospect of years of losses and an uphill climb to draw loyal users. Jet projected it would burn through hundreds of millions of dollars in its first few years, spending much of that money on marketing.

Mr. Lore won over investors in part because of his success running Diapers.com parent Quidsi, which was sold to Amazon for about $550 million in 2010.

For both Jet and Wal-Mart, Amazon’s frenzy of warehouse construction and fast delivery—as quickly as one-hour—have proved formidable. The Seattle -based online retailer has logged three straight quarters of record profit while locking in an estimated 60 million members to its $99-per-year Prime service, cultivating a loyal customer base and giving consumers fewer reasons to shop at traditional stores.

Wal-Mart would gain Jet’s sophisticated pricing software, as well as warehouses and customer data. The retailer also would get a brand that can appeal to higher-income shoppers, something Wal-Mart has struggled to do. Walmart.com shoppers’ mean annual household income was $58,000 in 2015, while Amazon shoppers made $68,000, according to data from Kantar Retail. Laura Kennedy, director of retail insights at Kantar, said Jet.com so far has been attracting a more affluent shopper base than Amazon.

Jet has yet to prove that its unique pricing and supply chain model is sustainable. The Hoboken, N.J., company had originally set out to charge customers a $50 annual membership fee, which it said would be its sole source of profits, and said it would use commissions toward lowering prices.

But Jet abandoned the business model in October after determining customers would resist the fee. As a result, Mr. Lore said prices that were originally 15% less than competitors would be about 5% less.

Shortly after its launch, Jet also rankled dozens of large retailers including Wal-Mart,Macy’s Inc. and Home Depot Inc. after it placed links to their sites without permission, promising its own members cash back for making purchases after clicking the links. Jet swiftly removed the logos and links of many of the retailers after The Wall Street Journal made inquiries.

Following the snafus, Jet scaled back its funding plans after originally talking to investors about a $2 billion valuation. Jet settled in November with investors at a value of $1.35 billion, becoming one of the fastest startups to ever cross the billion-dollar mark.

—Rolfe Winkler and Telis Demos contributed to this article.

Comments are closed