Key measure of corporate profits rose this spring alongside modest growth in the overall economy

By BEN LEUBSDORF

A divide at the heart of the U.S. economy—consumers ramping up spending while businesses pulled back—has left overall growth stuck in the slow lane for now.

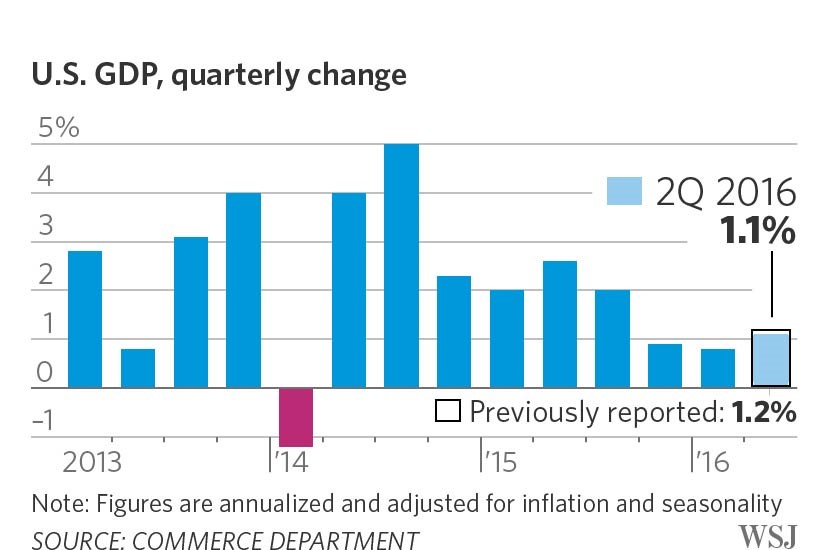

Household outlays surged this spring at their strongest pace in a year and a half, but business investment declined for the third straight quarter. The result was a modest 1.1% annualized economic growth rate in the second quarter, according to revised Commerce Department data released Friday.

Company earnings also remain under pressure, potentially restraining investment in the coming months. A key measure of corporate profits rose 4.9% in the second quarter, but gains this year haven’t been enough to offset a drop last year. Second-quarter profits were down 2.2% compared with a year earlier.

%THE WALL STREET JOURNALSource: Commerce DepartmentPoorer ProfitsAlready anemic growth in after-tax corporate profits (without inventory valuationand capital consumption adjustments) looks even weaker after recent downwardrevisions are taken into account.As reported the previousquarterMost recent revisions2012’13’14’15’16-20-100102030

Profit margins “are clearly past their cyclical peak” and “set to compress further over coming quarters,” Richard Moody, chief economist at Regions Financial Corp., said in a note to clients. As a result, “the risks to business investment remain tilted to the downside.”

Overall economic growth has been tepid since late last year, with GDP advancing at a modest pace of 0.9% in the fourth quarter of 2015 and 0.8% in the first quarter of 2016. But U.S. growth has been poised to accelerate over the summer; forecasting firm Macroeconomic Advisers on Friday predicted GDP would expand at a 3.2% rate in the third quarter, the best performance in two years.

“Inventories were a major drag on growth in the second quarter, but now that businesses have better aligned inventories with demand, that should lift and inventories will add to growth in the near term,” PNC Financial Services Group chief economist Stuart Hoffmansaid in a note to clients.

Friday’s report showed slightly weaker second-quarter GDP growth compared with the government’s initial estimate last month of 1.2%. Growth in consumer spending this spring was revised up, offset by larger declines than had been previously estimated for residential construction and government expenditures.

Consumer spending jumped at a 4.4% annual rate in the April-to-June period, the strongest gain since the fourth quarter of 2014. But fixed nonresidential investment, a measure of business spending on equipment and other items, declined at a 0.9% pace following larger drops in the prior two quarters. The slump partly reflects weakness in the domestic energy industry because of low prices for oil and other commodities.

What Changed in Second-Quarter U.S. GDP Report

Federal Reserve Chairwoman Janet Yellen took note of the divide Friday in a speech at the central bank’s annual retreat in Jackson Hole, Wyo., contrasting “solid growth in household spending” with “soft” business investment. Fed officials had flagged the same divergence in their last two policy statements.

There are some tentative signs of stabilization for business purchases of new equipment. New orders for nondefense capital goods excluding aircraft have risen the past two months, according to the Commerce Department.

But profits at U.S. corporations have been stressed in recent years by weak foreign demand, a strong dollar—making U.S. goods more expensive for foreign customers—and the energy sector’s woes. Margins could also be squeezed ahead by other factors including rising labor costs and caution among some U.S. consumers.

That in turn could restrain businesses’ ability to buy new equipment, facilities, software and other products.

“Although I expect business fixed investment to begin to grow again in the second half, it will likely remain soft, as profits have stagnated and election-year uncertainty could act as an additional depressant,” Federal Reserve Bank of New York President William Dudley said last month.

THE WALL STREET JOURNAL Note: All figures adjusted for inflation and seasonality Source: Commerce Department What’s Growing Percentage change since the end of 2013 in select GDP components Consumer spending on goods ($4.03 trillion total)Consumer spending on services ($7.46 trillion total)Business investment ($2.17 trillion total)Residential fixed investment ($0.59 trillion total)Exports ($2.11 trillion total) Imports ($2.67 trillion total)Federal government spending ($1.12 trillion total)State and local government spending($1.78 trillion total)2014’15’16-2.50.02.55.07.510.012.515.017.520.022.525.0

Write to Ben Leubsdorf at [email protected]

Comments are closed