Key Takeaway

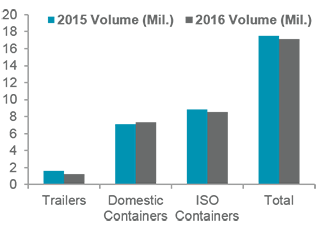

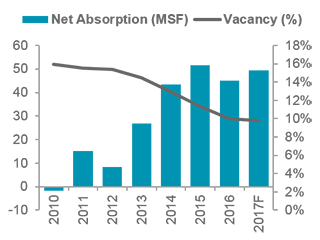

North America intermodal rail shipments eased a bit in 2016 with full-year intermodal freight volumes down 3.3% compared to 2015; however, 2016 still ranked as the second highest full-year volume on record, according to the Intermodal Association of North America (IANA). Despite the slowdown, demand for rail-served facilities remained healthy with 22.1% of the record-setting 282.9 million square feet (MSF) of overall industrial net absorption registered in 2016 occurring in rail-served properties located within one mile of a rail spur. Of course the impact of rail on industrial leasing is not limited to within a single mile, rail is an essential component of many supply chains and intermodal transfer facilities propel market activity elsewhere. |

|

Want to See the Data? Read On

Consumer’s Charm and Economic Mojo

Considering that consumer goods comprise much of what is inside containers and trailers, there is a positive correlation between intermodal volumes and GDP, and an even stronger correlation between intermodal volumes and consumer spending. The same holds true for industrial-related leasing. Given Cushman & Wakefield’s forecast for U.S. real GDP to grow by an upwardly revised 2.3% in 2017 before registering 3.0% in 2018 — driven in large part by stronger consumer spending — the near-term outlook for intermodal freight volumes and industrial-related leasing are promising. With import expansion growing 2.5 times faster than GDP, and with the JOC Container Shipping Outlook calling for U.S. imports to advance 6.0% in 2017, logistics-related real estate should see another strong year of leasing. |

| #2 |

2016 WAS SECOND HIGHEST

YEAR ON RECORD FOR

INTERMODAL VOLUME |

|

| 590 bps |

| DECLINE IN VACANCY FOR RAIL-SERVED PROPERTIES IN THE CURRENT EXPANSION |

|

|

|

|

Working on the Railroad

There are seven Class I railroads serving the United States that haul the largest share of domestic and international goods. The railroads — BNSF Railway, Union Pacific Railroad, CSX Transportation, Norfolk Southern, Canadian National, Canadian Pacific and Kansas City Southern Railway — transport a variety of bulk and retail goods and all are investing heavily in upgrading the nation’s private rail network.

U.S. freight railroads are planning to spend an estimated $22 billion on the task in 2017. Railroads are seeking to realign their service networks to favor truck-competitive intermodal and merchandise services in an effort to adjust to evolving supply chains and to bolster freight volumes. |

| 2.5 x |

IMPORTS ARE GROWING

2.5 TIMES FASTER THAN U.S.

REAL GDP |

|

| 6% |

| 2017 FORECAST FOR IMPORT GROWTH BY JOC CONTAINER SHIPPING OUTLOOK |

|

|

|

|

Back on Track?

As of Q4 2016, there were over 200 rail operator-owned intermodal facilities across North America. It is apparent that where these hubs emerge, industrial real estate demand follows. Since 2010, 185 buildings totaling over 61.9 MSF of new rail-served product has come online. During the same period, rail-served facilities have seen vacancy rates fall 590 bps, from 15.8% in 2010 to 9.9% in 2016. By comparison, overall logistics-related warehouse vacancy rates have fallen by 510 bps during the same period and currently registers 5.6%.

The IANA expects a recovery in intermodal volumes in 2017 and is hoping that inbound discretionary cargo finds its way back on the rails. A rebound is possible, but it is unlikely that trucking will hit the brakes. Given bottlenecks at ports, cheaper diesel fuel, and more pressure on timed deliveries, the open road will remain full of trucks. Looking forward, expect intermodal-proximate facilities, and production and distribution space that allows for quick, efficient and reliable delivery, to remain in high demand. |

|

2016 North America

Intermodal Volumes

|

U.S. Rail-Served

Property Performance

|

|

|

| Sources: Intermodal Association of North America (IANA), Cushman & Wakefield Research |

|

|

Comments are closed