Key Takeaway

Every new administration creates uncertainty as firms and markets attempt to discern the effect of new policies. In terms of trade policy, President Trump has stated, “I believe strongly in free trade but it also has to be fair trade.” It remains to be seen what the president will do to create such an environment, but his early actions indicate a focus on curbing the U.S. trade deficit, both by bolstering U.S. exports and reducing foreign imports. As policy details emerge, firms will examine their global supply chain networks to determine how it will impact their operational costs. Some have feared a “trade war” with countries like China and Mexico. Given the strong economic ties and importance of those export markets to U.S. firms, such a scenario is unlikely.

Want to See the Data?

Read on or view our full report titled Perspective: The Impact of Trade on the Industrial Market

| CLICK HERE FOR FULL REPORT |

The Trump Effect

The Trump Effect

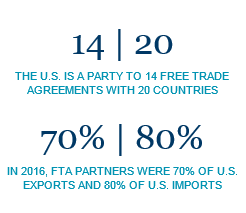

The U.S. has complicated trade obligations embodied in 14 free trade agreements (FTA) with 20 countries, the World Trade Organization, and other aspects of international law. U.S. FTA partners are important, representing nearly 70% of exports and more than 80% of all U.S. imports by value in 2016.

President Trump recently signed two executive orders on trade. The first concentrates on tougher enforcement of anti-dumping penalties and c

ountervailing duties — a mechanism used against foreign governments that subsidize their producers and sell goods at below-market prices. The second calls on the Commerce Department to produce a comprehensive report within 90 days to identify “every possible cause of the U.S. trade deficit.”

China – In The Red

China – In The Red

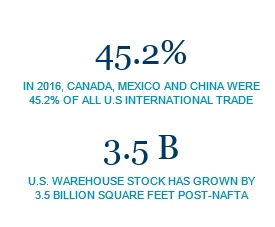

In 2016, the U.S. trade deficit was $749.9 billion, with China accounting for $347 billion. China is currently the second-largest trading partner to the U.S., its third-largest export market, and its biggest source of imports. Chinese imports are also a driver of industrial-related warehousing demand, particularly on the West Coast.

Although China has significantly liberalized its economic and trade policies over the past three decades, it continues to maintain a number of state-directed policies that some say distort trade and cause friction with the U.S. These policies will likely continue to be a source of heightened tension, but given, among other things, the importance of China as an export market and its growing consumer class (which will exceed the entire population of the U.S. by 2026), a trade war between the world’s two largest economies is not likely.

NAFTA – Time For A Refresh?

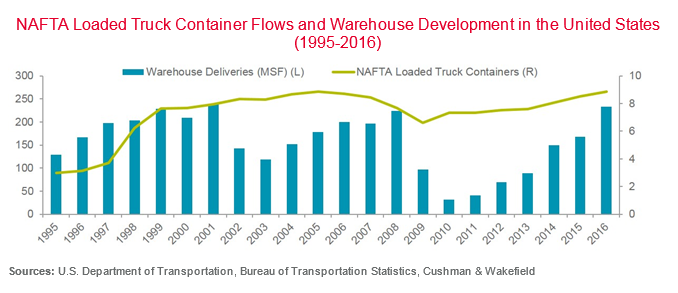

U.S. trade with NAFTA partners has more than tripled since the agreement took effect, increasing more rapidly than trade with the rest of the world. NAFTA also has increased the amount of truck traffic. Since 1995, annual loaded truck containers into the U.S. have increased 184.1%. As cross-border trade flows have increased, so, too, has the need for additional warehousing. Since 1994, the effective date of the agreement, U.S. warehouse inventory has increased on net by 3.5 billion square feet.

Neither Canada, Mexico, nor the U.S. have stated specifically how NAFTA should be renegotiated or what changes may be sought if the agreement is amended, but all three countries have recognized the need for the trade agreement to be updated. Renegotiation may provide opportunities to modernize it by addressing issues not currently covered, including new provisions related to the automotive sector, eCommerce, energy, and new customs and trade facilitation procedures. We expect some renegotiation to occur, but do not anticipate a complete U.S. withdrawal from the trade agreement.

Comments are closed