WILMINGTON, Mass.—When Target Corp. decided to revamp one of its biggest California distribution centers, it had a choice. It could build a new warehouse, it could install established technologies for picking products off shelves or it could take a risk on a new breed of robots from a reclusive billionaire.

Target went with the billionaire’s bots.

Target’s new automatons are from Symbotic LLC, part of a grocery empire run by New England billionaire Rick Cohen. Mr. Cohen, through his own national distribution network, and deals with some of the nation’s biggest retailers, aims to show that robots can overturn the business of storing, handling and hauling the cases of goods that retailers truck to their stores by the millions each year.

His sales pitch to grocery chains and retailers, including Target, Coca-Cola Co. and Wal-Mart Stores Inc. is simple: Symbotic’s automation system includes autonomous robots that can travel untethered among storage racks in a distribution center. They can move up and down aisles to stack and retrieve cases. They coordinate with more-conventional robots that perform simpler tasks.

That is in contrast to many other warehouse-automation systems, in which the robots tend to be bolted down or limited to fixed routes or tracks and are less flexible in what they can do.

“What we’re doing with autonomous bots is not that dissimilar from what Google is doing with autonomous cars,” Mr. Cohen said in an interview at Symbotic’s Wilmington headquarters. “I think within five years, it’ll change distribution.”

A Symbotic autonomous robot, resembling a small driverless go-cart, travels on ledges down a storage-rack aisle to pick out products in a C&S Wholesale grocery-distribution center in Newburgh, N.Y. PHOTO: MICHAEL RUBENSTEIN FOR THE WALL STREET JOURNAL

For retailers, the objective in automating warehouses is controlling the three big costs of conventional human-staffed distribution centers—labor, time and real estate—to meet the demand of the high-cost, low-margin industry.

“Every project we look at, we look at automation as a potential part of it,” said Frank Bruni, Kroger Co.’s vice president of supply-chain operations. The grocer has bought warehouse-automation systems from Germany’s Witron Logistik + Informatik GmbH, a Symbotic competitor.

About 6% of Kroger’s distribution centers are fully automated, Mr. Bruni said, and a warehouse-worker shortage, rising wages and other factors are driving the company to look at more robotic systems. “Twenty-five, 30 years ago, there were a lot of folks who made careers working in warehouses. Today I don’t think that dynamic exists as much.”

Target in 2013 wanted to expand its Woodland, Calif., distribution center to keep up with rising Southwest sales. It considered building a new center, then went with Symbotic in 2014.

“Target was going to have to build a new facility in California, which is horrendously expensive,” said Larry Sweet, a Georgia Tech robotics professor who was Symbotic’s chief technology officer until last year and worked on the Target project. “They wanted that facility to handle more volume, but they couldn’t do it. Symbotic was able to put a system in the building that helped that.”

Robots Take On the Warehouse

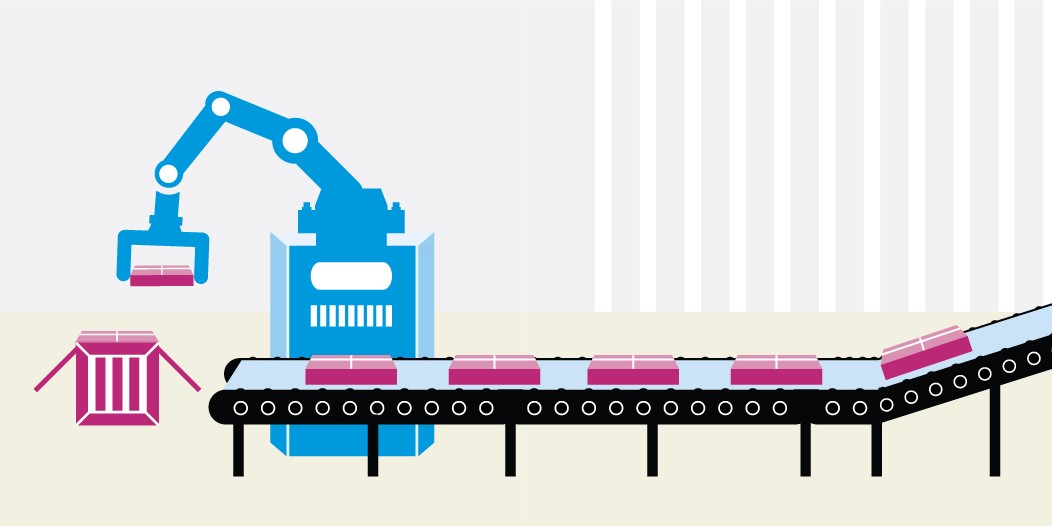

Symbotic, a robotics company owned by the CEO of grocer C&S Wholesale, is trying to upend the business of storing and shipping groceries. Here’s how a typical Symbotic distribution center works.

Trucks unload cases of products, which are ferried by a forklift and unwrapped.

A stationary robot separates the load into individual cases of each product. The cases are recorded into Symbotic’s software system and travel by conveyor to…

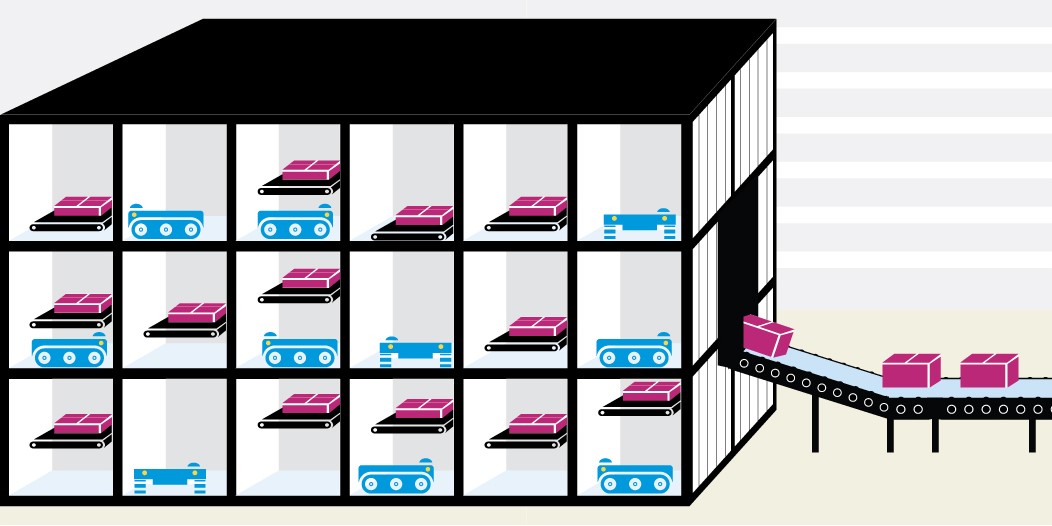

…”The Box,” a huge metal enclosure divided into multiple levels, each with multiple aisles.

Symbotic’s autonomous robots zoom up and down aisles at speeds of up to 25 miles per hour, storing and retrieving cases of food products. The aisles are about 28 inches wide.

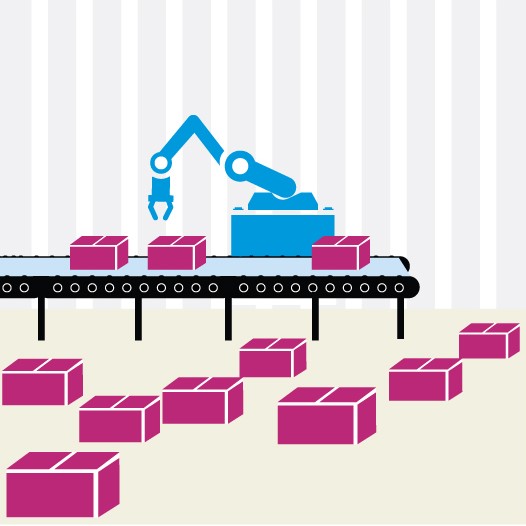

Robots arrange cases in the order determined by software and assemble them into “perfect pallets” according to a grocery store’s layout.

Another robot wraps the pallets, which can be up to 9 feet high, with plastic wrap.

The pallets are loaded into a truck and shipped to the supermarket.

Until now, consumer-products retailers have found it hard to automate even simple procedures such as picking products off a rack and assembling odd-shaped containers on a pallet. Such tasks were performed by about 867,300 people in warehouses across the U.S. as of August, according to the most recent Labor Department data.

Food, in particular, has resisted robots. In the food-and-beverage sector, where Mr. Cohen got his start, just 8% of distribution centers owned by the 75 largest North American grocers are partially or fully automated, according to supply-chain consultancy MWPVL International Inc. Food wholesalers and distributors operate on thin profit margins—typically 1% to 2%—making them reluctant to invest in automation, which can cost up to $100 million for a warehouse.

That attitude is shifting as rising labor and land costs threaten profits. And they face increased competition from Amazon.com Inc. and other technology firms that are overturning longstanding practices.

Labor impact

The International Brotherhood of Teamsters, representing 122,000 grocery-warehouse workers, has been put on the defensive by the rise of automation, said Steve Vairma, head of the union’s warehouse division. “Employers are looking to move more and more into automation,” he said, “and I think we’re going to be faced with those challenges in contract negotiations in coming years.”

Mr. Cohen’s Symbotic approach is ambitious because use of autonomous industrial robots is still in its infancy. Developing robots that can work untethered has been something of a crusade for engineers at manufacturers such as Boeing Co., which are spending heavily on them. A robot that knows its way around a factory, the argument goes, can do assembly tasks more efficiently than its fixed-in-place ancestors.

It is still difficult for robots to perform precise tasks in chaotic environments, said Martial Hebert, a Carnegie Mellon University professor who specializes in vision and recognition systems for autonomous robots. Advanced sensors and software are bringing down some of those barriers, he said.

“The areas in which automation moves the fastest are the areas where the environment is the most structured, things like factories or warehouses with limited amounts of products,” Mr. Hebert said. “We’re getting to the point where the technology is really moving to the real world.”

After they arrive at C&S Wholesale’s Newburgh warehouse, packages of grocery products are separated by fixed-in-place robots into individual cases and move along conveyors. PHOTO: MICHAEL RUBENSTEIN FOR THE WALL STREET JOURNAL

Mr. Cohen is carrying out his experiment through C&S Wholesale Grocers Inc., the country’s largest wholesale grocery distributor by sales, of which he is the third-generation chief executive.

His strategy has two prongs: Install robots in C&S warehouses to serve grocery chains, and sell them to companies that have their own distribution facilities. Over the next year, Symbotic plans to roll out nearly a dozen fully-automated food warehouses across the country from Pennsylvania to California, serving grocery chains.

He has reached an agreement to supply robots to Target and Coke’s distribution facility in South Brunswick, N.J.

Wal-Mart said it is testing Symbotic’s system for use in up to two of its large distribution centers. Wal-Mart is interested in how the robots allow it to store more products in its warehouses.

Symbotic said its system allows food retailers and wholesalers to cut distribution-center labor costs by 80% and operate warehouses that are 25% to 40% smaller.

The company faces competition in the U.S. market from companies such as Atlanta-based Dematic Corp. and Austria’s Knapp AG, which have installed systems that use robots to store and retrieve cases of food and consumer products. A number of smaller companies are working on ways of using autonomous robots to pick and pack individual items to fulfill online-shopping orders directly to customers.

For evidence robots work in food warehouses, U.S. distributors can look to Europe, where land and labor costs are higher and automation in food distribution is more common.

“In the long run, if you don’t automate, eventually…it will really limit your supply chain,” said Norman Leonhardt, head of sales for Witron, the German automation firm. “America is moving towards it. There aren’t enough young people coming into the workforce who really want to work in warehouses.”

Witron has installed automation in more than a dozen distribution centers in North America run by companies such as Kroger, Target and Meijer Inc. Witron says its systems don’t use autonomous robots.

Packages move along conveyors into a large metal storage enclosure Symbotic engineers call ‘The Box,’ in which the autonomous bots will travel to pick out products for packing onto pallets. PHOTO:MICHAEL RUBENSTEIN FOR THE WALL STREET JOURNAL

Symbotic demonstrates its robots’ potential in a C&S grocery warehouse in Newburgh, N.Y., where they are juxtaposed with humans.

On one side, a team of about 20 human “selectors” lined up around 9 p.m. to stretch. A manager gave a motivational speech about safety and efficiency as they prepared for an overnight shift using forklifts to retrieve cases of paper towels and canned vegetables, loading them by hand onto pallets. Warehouse pickers can walk up to 20 miles and lift 50,000 pounds during a shift, according to occupational-health studies.

Bots in ‘The Box’

On the other side of the warehouse, more than 100 Symbotic robots, resembling driverless go-carts, whizzed freely among racks before driving onto ledges along narrow aisles in a multi-leveled metal enclosure company engineers call “The Box.” They can travel at 25 miles an hour in the dark and use mechanical extender arms to stow and retrieve cases. The bots communicate using sensors and a wireless network.

They are limited at this point to ferrying objects of regular sizes and solid surfaces, such as cardboard boxes. The occasional spill or cracked container can throw the robots off until fixed by a human.

The autonomous bots delivered products to less-mobile cousins in the warehouse. A fixed-in-place robot separated individual cases of canned tomatoes and macaroni-and-cheese from pallets by loading them on conveyors, from which a lift transported them into the Box, where other robots waited to grab them and store them in racks.

At the other end of the Box, robots ferried the cases to another area, where two fixed robots arranged them into pallets up to 9 feet high, then shrink-wrapped them to be trucked to supermarkets.

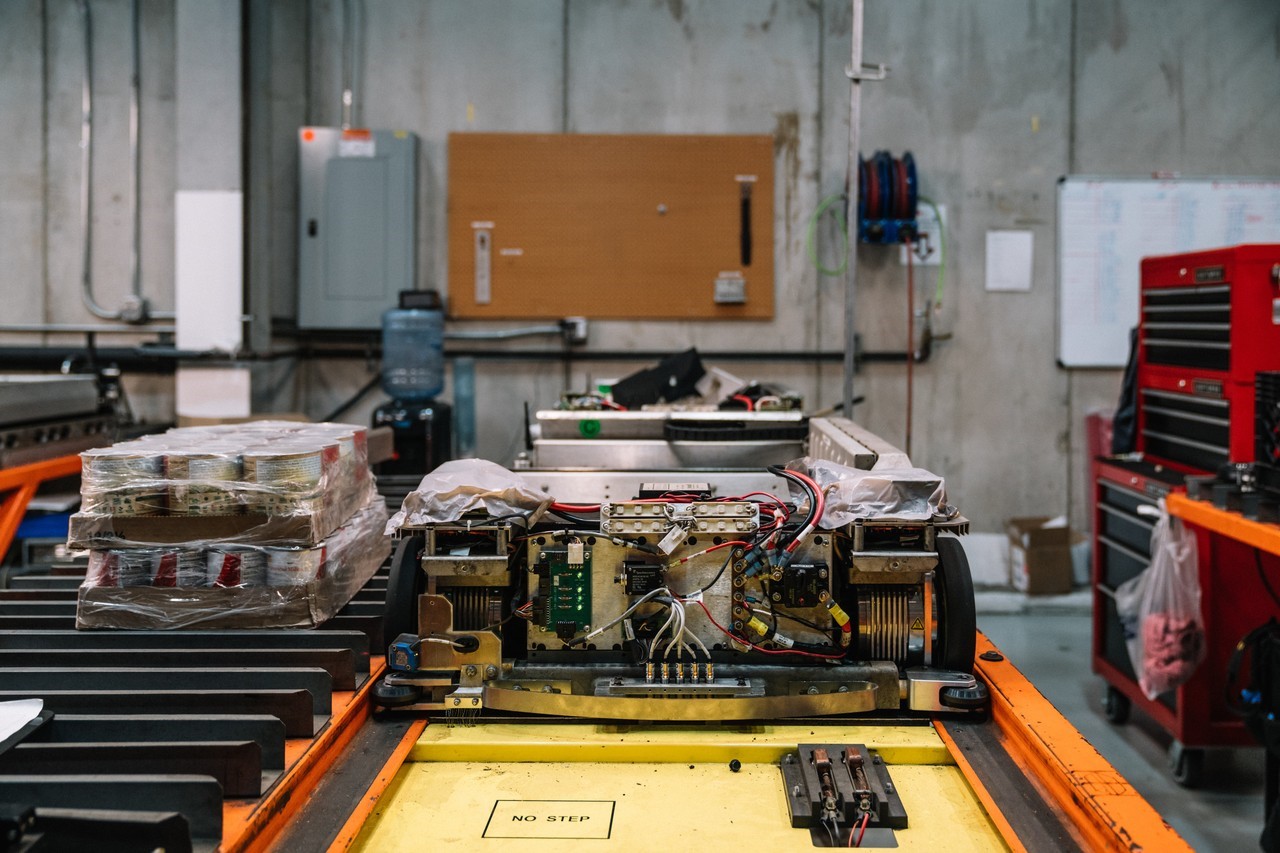

When a Symbotic robot is ‘sick’ or malfunctioning, it takes itself out of the storage system and alerts technicians to conduct repairs or maintenance. Here, a robot is serviced at the Newburgh, N.Y., facility. PHOTO: MICHAEL RUBENSTEIN FOR THE WALL STREET JOURNAL

Unlike in conventional warehouses, where cases of a given product tend to be stored in the same section so humans can find them, Symbotic’s robots can put any product in any spot on the racks—mayonnaise rubs elbows with peanut butter and coffee—allowing for denser storage. The robots’ software notes where each product is stored, and the bots can then find them to construct “perfect pallets” organized in sequence according to individual supermarkets’ floor plans.

Each of Symbotic’s autonomous robots can drop off and retrieve one case of products a minute, about five times as fast as a human can on foot. The robots are 28 inches wide and the aisles they travel only slightly wider, compared with the 10-to-12-foot aisles of a conventional warehouse.

Mr. Cohen said he became interested in robotics because of a lifelong passion for cutting fat at his family business. His grandfather, Israel Cohen, founded C&S in Worcester, Mass., in 1918. Mr. Cohen became CEO in 1989 and is sole owner.

Over the years, he said, he has experimented with warehouse robots in C&S facilities, building on an earlier hobby of making computers from kits. He said his allergy to waste led him to invest in Symbotic in 2007 and later buy the rest of it.

“Taking waste out is fascinating to me,” Mr. Cohen said. “I walk through a warehouse, and everyone sees what’s happening, and I see what’s not happening.”

One limiter on Symbotic’s growth is cost. Its systems can run between $40 million and $80 million for equipment, according to MWPVL, the consultant, an investment big enough to make some distributors blanch.

Still, labor costs are “going to hit the grocery industry really hard,” MWPVL founder Marc Wulfraat said. “Most young people would rather work at a desk than hoofing cases around.”

‘The Box’ is a towering metal enclosure storing grocery products that Symbotic robots pick out for packing onto pallets to ship to stores. The system can shelve dissimilar products together because its software remembers where every case is. PHOTO: MICHAEL RUBENSTEIN FOR THE WALL STREET JOURNAL

Write to Robbie Whelan at [email protected]

Comments are closed