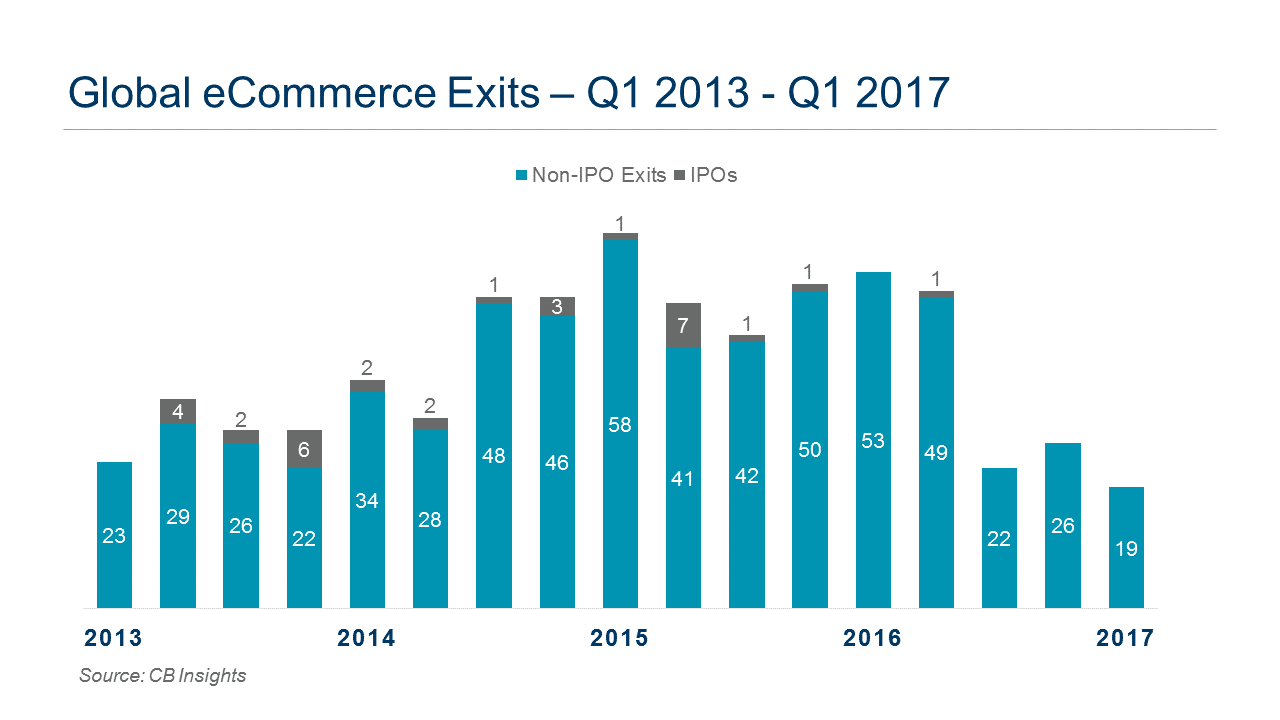

Sale Exit

No question, the most common type of liquidity event in the eCommerce space over the last few years has been M&A. We expect the pattern to continue.

Among the key drivers of the jump in investment and in deal count in this space are the following:

- An ever-weakening physical retail market compels retailers to aggressively build their portfolio of brand extensions in a frantic attempt to survive. The status quo is not enough to sustain many traditional retailers; they’re not able to grow organically, so buying online players is for many the preferred (only?) course.

- M&A builds a broader customer base, often with a different, more attractive, demographic profile than the acquirer.

- The acquisition of certain eCommerce players can add brand buzz and cache to flagging retailers.

- M&A can build a longer inventory “tail” to offer shoppers more variety, which is counted on to drive deeper customer engagement and loyalty. This SKU proliferation, however, poses its own challenges.

- Enhancing the acquirer’s technology portfolio by leveraging expertise and systems that may be faster to market than developing advances organically.

- Instantly acquiring executive talent, subject to management contracts, that may be critical to growth and stability of the acquirer.

- Onboarding specialty expertise in operations, merchandising, and customer engagement can be faster than growing that talent internally.

- Establishing relationships with new manufacturers and suppliers may prove critical to expanding the brand portfolio and to leveraging favorable terms.

- And perhaps most importantly, M&A can jump start getting to sufficiently increased scale to improve companies’ competitive position Vis a vis the market leader Amazon. Right or wrong, the common expectation is that only the larger, more diversified aggregators of disparate brands have the better shot at competing with Jeff Bezos.

Exit by sale can sometimes be the best outcome, yet still painful. As select players see their growth rates slow and interest from other capital sources wane, some retailers find themselves with few options other than a deal at fire-sale prices. Earlier round valuations don’t necessarily align with final sale prices.

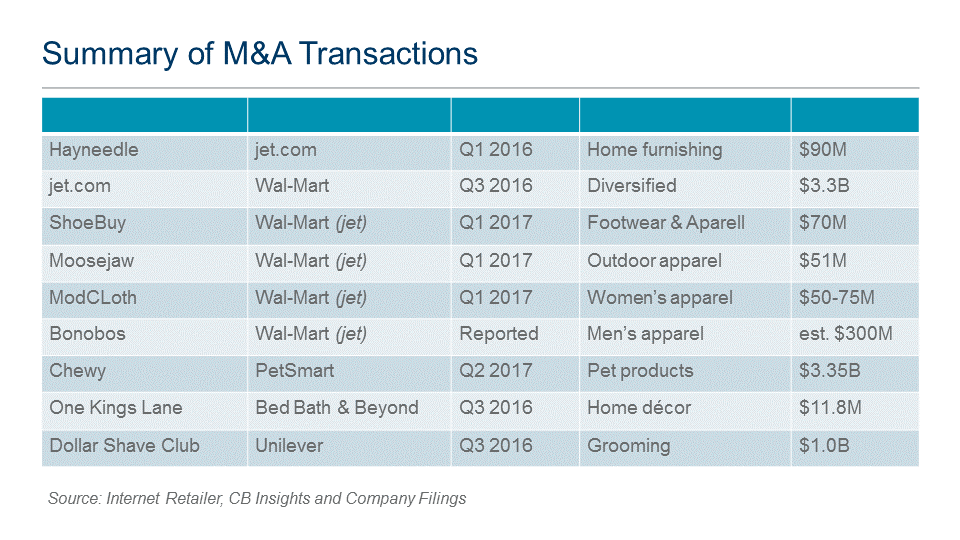

Selected, Noteworthy Wal-Mart Acquisitions

Wal-Mart continues to be the most active acquirer of eCommerce companies, as part of its renewed commitment to accelerate online growth. Its M&A strategy is the cornerstone of building out the online presence that Wal-Mart.com CEO Marc Lore says is needed to be a compelling competitor with Amazon.

After a number of years of significant investment attempting to grow its online business organically with limited results, the 2016 acquisition of jet.com signaled Wal-Mart’s determination to fuel its growth through acquisitions. Indications are that each of these brands will remain independent of the parent company to maintain the loyalty and brand equity of each.

Among key deals by Wal-Mart and its affiliates are the following:

| |

jet.com – Acquired for $3.3B in 2016, at the time the largest eCommerce M&A deal ever, demonstrated Wal-Mart’s new focus. As we have reported in this space previously, jet.com brought Wal-Mart outstanding, innovative executive leadership, proprietary cart pricing technology, a growing national distribution network, and a significantly different customer demographic and brand cache, very different from Wal-Mart’s historical image. Customer extension was significant with little overlap: BizRate reports only 17% of jet.com customers had shopped walmart.com in the previous six months.

Hayneedle – jet.com acquired Hayneedle.com in 2016 prior to the Wal-Mart deal for a reported $90 million. The retailer of indoor and outdoor home furnishings had reportedly been marketed for sale for up to a year before its sale to jet.com.

ShoeBuy – Acquired by jet.com in early 2017 for a reported $70 million. The company expands Wal-Mart’s apparel and footwear selection through 800 brands and sells extensively through online marketplaces including Amazon, Shop.com and Google Shopping. In April, ShoeBuy acquired the shoes.com URL to which web traffic is now channeled.

Moosejaw – Acquired by jet.com in February for a reported $51 million, the retailer provides a significant extension of outdoor clothing and accessories not found elsewhere in the Wal-Mart ecosystem. Bringing brands such as Patagonia and North Face, the company is seen as a “quirky” high-end retailer. The Moosejaw shopper is a more affluent one, with 60% of Moosejaw’s customers earning above $60,000 per year versus the Wal-Mart average of 52%.

ModCloth – Acquired in March, reportedly for somewhere between $50 and $75 million, ModCloth is a further migration of apparel brand image and style, away from legacy Wal-Mart. The acquisition price is believed to be roughly equal to the VC investment to date. The self-proclaimed “feminist fashion brand aesthetic” brings its parent company a significantly different shopper demographic and a very loyal base.

Bonobos – While not a done deal, reports are a deal is imminent for the acquisition of the fast-growing men’s online and unique physical store presence apparel concept. Speculated to trade at $300 million, the deal would be Wal-Mart’s largest online deal since jet.com. Not only would Bonobos bring its unique Guideshop store model and its more stylish brand image, it would also deliver an even more significantly different customer demographic. Per Internet Retailer, 22% of Bonobos’ customers earn between $100,000 and $150,000, with 21% earning more than $150,000. Wal-Mart’s breakdown is lower, at 10% and 6%, respectively. |

Household income and college education are two measures of how the three 2017 deals, plus a Bonobos transaction, would bring in a different shopper demographic in the aggregate. BizRate reports that the four companies have greater than 57% shoppers with household income greater than $75,000, versus 41.5% for Wal-Mart stand alone. Similarly, greater than 66% of customers of the subject four retailers have at least college degrees, versus less than 50% for Wal-Mart.

We will see how impactful these acquisitions and those to come in the still small walmart.com business will be to the nearly $500 billion revenue organization. Building a portfolio of such unique and disparate brands is not without risk. Maintaining independent branding and leveraging cross-brand economies and technologies out of the customers’ view will likely be key. An in-the-market association with Wal-Mart could result in significant erosion of the brand value each can bring.

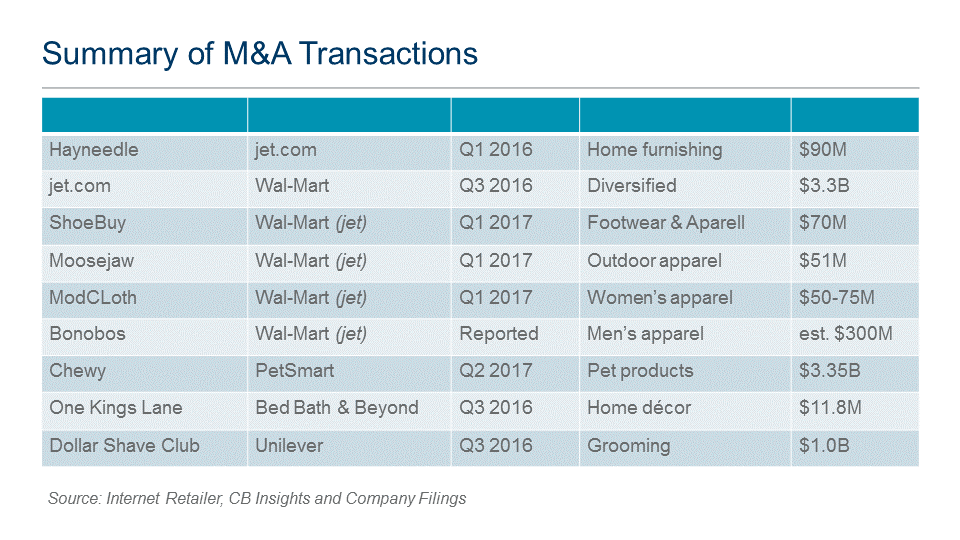

Wal-Mart Is Not Alone in eCommerce M&A

While Wal-Mart has been the most active, other primarily physical retailers have also completed significant acquisitions of online leaders.

| |

Chewy – The number one online pet goods retailer in the U.S., Chewy is being acquired by PetSmart for a reported $3.35 billion, slightly richer than jet.com’s valuation, in what would be the largest online deal in history. For physical pet goods retail leader PetSmart, Chewy brings its market-leading share of online pet foods (57% versus 33% for Amazon, 4% for Petco and 2% for PetSmart). Founded in 2011, Chewy has grown annual revenues to a reported $900 million in 2016, making it #57 in sales among U.S. eCommerce retailers; this is a huge lift from PetSmart’s online revenues of $71.8 million in 2016.

In addition to dominant market share, Chewy also brings to the deal a national fulfillment network of four facilities, plus a recently announced fifth to complement PetSmart’s store replenishment supply chain. Faced with having to create a compelling online presence to stay relevant as more sector growth was moving online, PetSmart chose to go all-in by acquiring the market leader.

One Kings Lane – As noted above, some eCommerce M&A activity is done at fire sale prices. Higher-end online flash sale décor retailer One Kings Lane was an example of this when it was acquired by Bed, Bath & Beyond in mid-2016 for $11.8 million, two years after it peaked at a $900 million valuation. The flash sale niche has proven to be particularly susceptible to poor performance, and hence low expectations and poor valuations.

Dollar Shave Club – Done in the third quarter of 2016 by Unilever for $1 billion, the Dollar Shave Club transaction is the boldest example to date of consumer product goods (CPG) companies making significant commitments to building their direct to consumer engagement. The valuation of the pure-play online subscription retailer stunned many observers. |

CPGs as a whole have seen their top line growth slow to near zero. In light of dim prospects for significant organic growth and recognizing the growth potential in online, we are seeing the start of what we are certain will be a powerful trend towards CPG investment in direct-to-consumer channels. The Dollar Shave Club deal is only the start.

And Where’s Amazon on This?

Amazon’s market dominance is often cited as the impetus for other retailers’ flowing such capital into eCommerce M&A recently. Since the game-changing flurry of acquisitions that included Zappos, Quidsi, ShopBop and Kiva Systems ended five-plus years ago, Amazon has focused more on acquisition of niche technologies pertaining to the cloud computing and other digital businesses, and not the core consumer business.

Earlier this year, Amazon broke that pattern with a reported $1 billion purchase of Dubai-based online retailer Souq. Souq reportedly was the target of multiple bidders. Amazon continues its pattern of investing significant capital in emerging technologies, but not outright acquisitions, such as the recent deal with alternative fuel cell developer Plug Power.

As it moves towards a larger physical store presence and to complement its Fresh offering, it has been speculated that Amazon is interested in acquiring a major grocery player, such as Whole Foods. While other potential acquirers have been rumored to be interested as well, we do not think it’s out of the question Amazon may make a bold move that would accelerate its physical store and Fresh rollouts.

Is Amazon done in the online retail M&A game and instead focusing exclusively on growing its next gen offerings internally? Don’t bet on it.

And Other Large US Online Players?

It remains to be seen how, if at all, other significant online players such as Wayfair and Overstock might participate in the online M&A rush. Some speculate Wayfair, with continued strong but lately slowing revenue growth plus growing losses, could be a target for Amazon, Wal-Mart, Target, Home Depot and others with the growth of the online home furnishings sector. At a market capitalization of $5.25 billion, it is clear a Wayfair acquisition would be the largest online deal in history. Or in spite of its considerable cash burn rate, would Wayfair be a potential buyer of select niche companies? In the meantime, Wayfair continues to grow its network of fulfillment centers and other delivery infrastructure across the country.

Overstock, with slowing revenue growth, yet lately generally profitable and with a market capitalization of $385 million, might be a target for Wal-Mart or another player looking to further extend into home furnishings, electronics, apparel, or jewelry.

Accessory Businesses Seeing Significant M&A Activity

Online and physical retailers are not the only players in M&A of late. Other sectors that are indirect participants in the eCommerce disruption that have seen active consolidations or are ripe for same include global parcel carriers (UPS, FDX), 3PLs, last mile (Deliv, Curbside, Instacart), material handling manufacturers (Vanderlande, Dematic), maritime and air cargo, and even online platforms (Salesforce).

In the scramble to scale and ultimately to reach sustained profitability, we can expect to see considerable deal flow still to come. As with all M&A activity, buying the brands is the easy part. The real challenges come in the integration of technologies, supply chains, cultures and people, and in the protection and leveraging of those brands.

And This All Means What to Industrial Real Estate?

We remain bullish on the industrial real estate market nationally, and specifically the continued strong impact eCommerce growth is having on the demand for space. We do not view the increased discipline around VC funding and IPO activity in this space as dampening the remarkable expansion of online growth and space requirements, in the U.S. or globally. The logistics real estate industry will continue to enjoy the benefits of that growth for the foreseeable future.

We also believe that the continued trend of former pure-play online retailers beginning or expanding their physical store presence will create an incremental demand for fulfillment/distribution space.

Consolidation in the number of independent occupiers in this sector does not denote contraction in demand for space. On the contrary, one can conclude that successful M&A activity will create a healthier sector with more players being financially stronger. It would be naïve to think that some right-sizing of select online retailers wouldn’t follow aggregation of select businesses. We believe, however, it would be short-sighted to overplay a long term negative impact on space demand from such economies of scale. Right sizing, trimming, begets healthy growth.

We expect the right deals will get capitalized and eCommerce will continue to grow, and with the maturity of more leading online players will come improved financial performance across the sector. Amazon’s seemingly unstoppable momentum will continue to provoke innovation and competition. This is a good omen for consumers, as it is for those involved with logistics real estate.

Demand for logistics real estate – of the full range of building types – will remain strong, driven by continued eCommerce expansion. That’s the deal. |

Comments are closed