Key Takeaway

With the economy near full employment, corporate leverage approaching levels observed at the peak of the prior business cycles, and the yield curve recently flattening, some are wondering if a recession is around the corner. Not so fast. A host of economic data (jobs, confidence, manufacturing and transportation measures, etc.) indicate that the current expansion still has room to run. Our U.S. Macro Forecast calls for continued growth through at least 2018. Others have similar expectations; Oxford Economics recently evaluated the odds of a U.S. recession in 2017 at 1%. Eventually, the current expansion will end, industrial leasing velocity will slow, and the business cycle will reset; however, that does not mean the U.S. industrial market will experience a prolonged slowdown or every industrial market will register negative net absorption.

Recessions are a natural part of economic and business cycles. Not all recessions, or recessionary triggers, are created equal. The 2001 recession lasted eight months, coinciding with the tech bubble burst and the 9/11 attacks. The Great Recession lasted 18 months and was sparked by the subprime mortgage crisis that created a global banking crisis. Regardless of length or trigger, industrial markets enjoying a diverse economic base, strong demographics, and the geographic advantage of being proximate to population centers (that have the infrastructure needed to reach them efficiently) tend to perform best when economic growth stalls. Below are six markets that posted positive net absorption during the past two recessionary periods and some of the logistical attributes of each.

Want to See the Data? Read On

Indianapolis, IN

Home to the second largest FedEx hub in the world, a large logistics workforce, and the most highway convergence in the nation, the Indianapolis industrial market is buttressed by its logistical advantages. Nearly 50% of all U.S. businesses and 80% of the U.S. and Canadian population can be reached within a one-day drive, tying its economy to the broader distribution and consumption of goods. |

#1

IN NET ABSORBTION REGISTERED DURING LAST TWO RECESSIONS

|

Denver, CO

Strategic infrastructure and business investments have helped diversify Denver’s economy. Its industrial market also benefits from positive domestic and international migration, which have driven population gains and supported leasing among logistics and food & beverage firms. Lower business costs, a highly educated workforce, and influx of young professionals have helped spur startup creation and attract a wide variety of occupiers. |

16 | 9

HOME TO SIXTEEN FORTUNE 1000 COMPANIES AND NINE INDUSTRY CLUSTERS

|

Pennsylvania I-81/I-78 Distribution Corridor

This corridor, stretching from Northeastern Pennsylvania through Lehigh Valley and into Central Pennsylvania, has emerged as one of the hottest distribution markets in the country. Its multi-modal infrastructure, low operating costs, regional and parcel freight hubs, and super-regional highway system connect it to Baltimore, Boston, Philadelphia, New Jersey, New York City, and Washington D.C., making it a prime location for eCommerce fulfillment. |

58.8%

TRANSPORTATION AND WAREHOUSING JOB GROWTH IN CURRENT EXPANSION

|

Memphis, TN

Known as America’s Aerotropolis, Memphis boasts the largest FedEx air cargo shipping hub in the world, as well as substantial UPS and USPS operations. Its infrastructure also allows for the efficient movement of product by rail and truck. Strong transportation links and below-average business costs have driven investment in warehousing and distribution centers, which has been complemented by growth in online retail and wholesale trade. |

#2

IN TOTAL METRIC TONNAGE OF AIR CARGO SHIPPED IN THE WORLD

|

Columbus, OH

Columbus boasts a multimodal logistics industry comprised of more than 4,100 firms and 80,000 workers. Its proximity to population centers and logistics assets—like Rickenbacker Global Logistics Park and the nation’s top Foreign-Trade Zones (FTZ) by value for textiles and footwear—has made Columbus a critical link in supply chains. It also has dynamite demographics, having led the Midwest in population growth since 2010 (4.6%). |

70%

OF U.S. IMPORTED TEXTILES AND FOOTWEAR BY VALUE MOVES THROUGH ITS FOREIGN TRADE ZONE

|

Nashville, TN

Nashville’s location, connectivity, and multiple modes of transportation underpin its industrial market. It is one of only six U.S. cities at the convergence of three major interstate highways. It is also a hub on the CSX rail system connecting 20 states, 140 freight carriers, and 150 truck terminals. Half of the U.S. population lives within 650 miles, and the region is within 250 miles of one-third of all U.S. car and truck assembly plants. |

1/3

LOCATED WITHIN 250 MILES OF ONE-THIRD OF ALL U.S. CAR AND TRUCK PLANTS

|

|

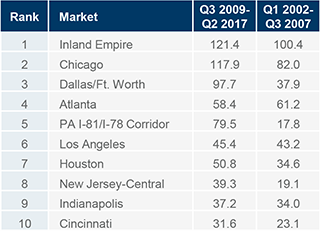

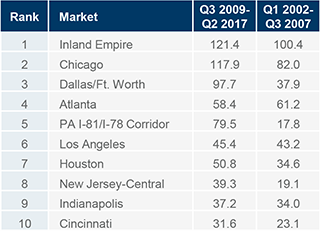

In Good Times and Bad

Top 10 Markets Ranked by Net Absorption During Expansion/Recession Periods

|

Expansionary Periods

|

|

|

Recessionary Periods

|

|

|

| *Markets registering positive net absorption during each of the past two recessionary periods

Note: Our analysis examines net absorption registered during the period in which the U.S. was technically in a recession, as determined by the National Bureau of Economic Research. Subsequent occupancy gains or loses are reflected in the following expansionary period. |

|

Comments are closed